Contract Creator

Create contracts of employment for new starters, that can be signed online and automatically stored in the employee database.

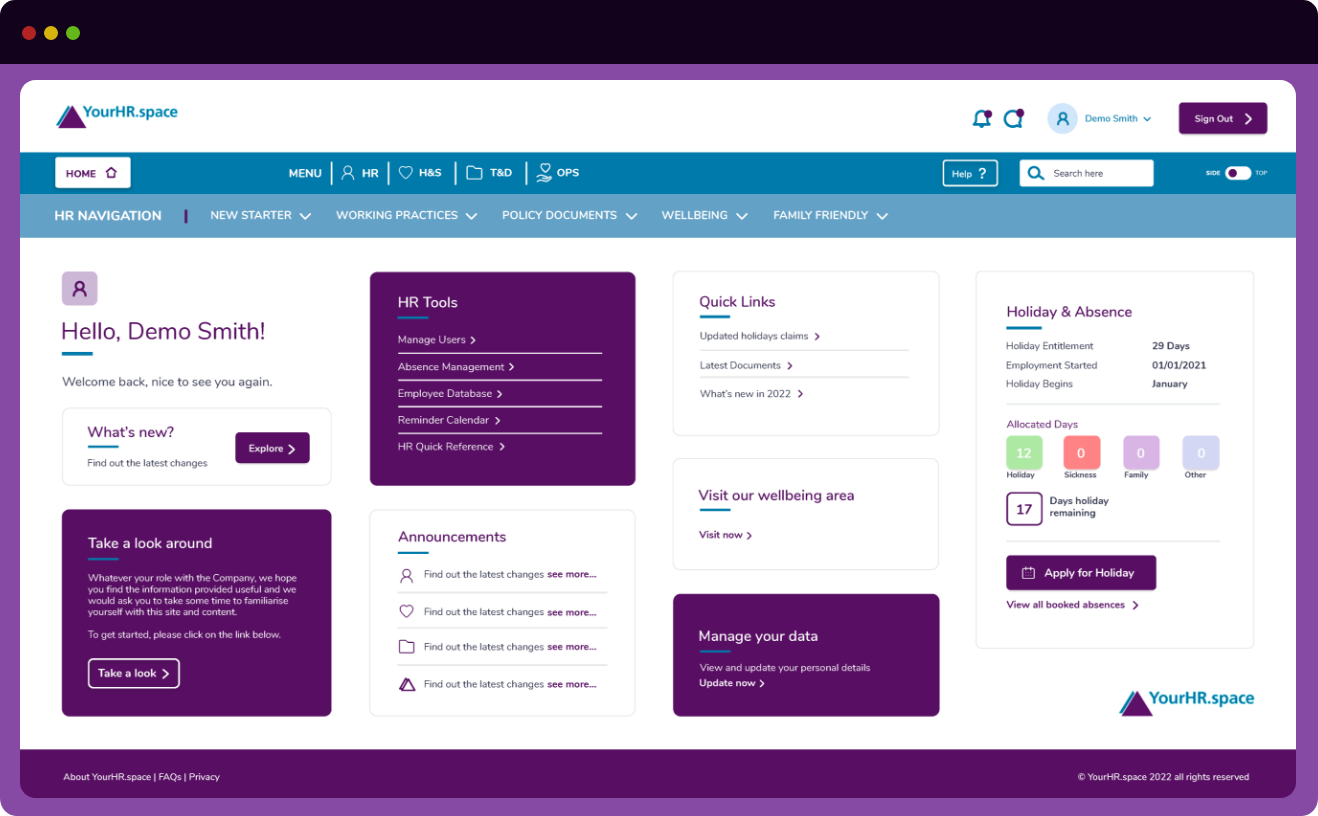

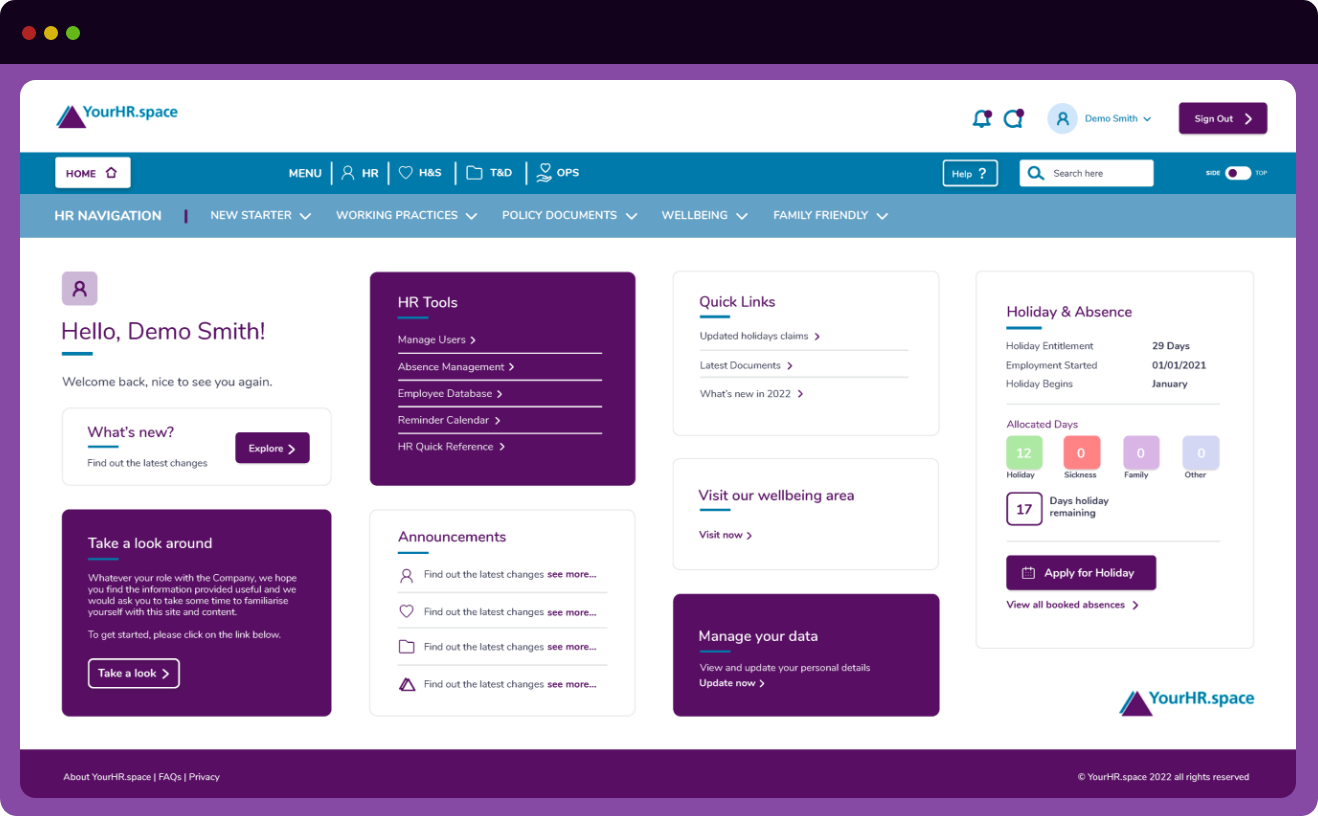

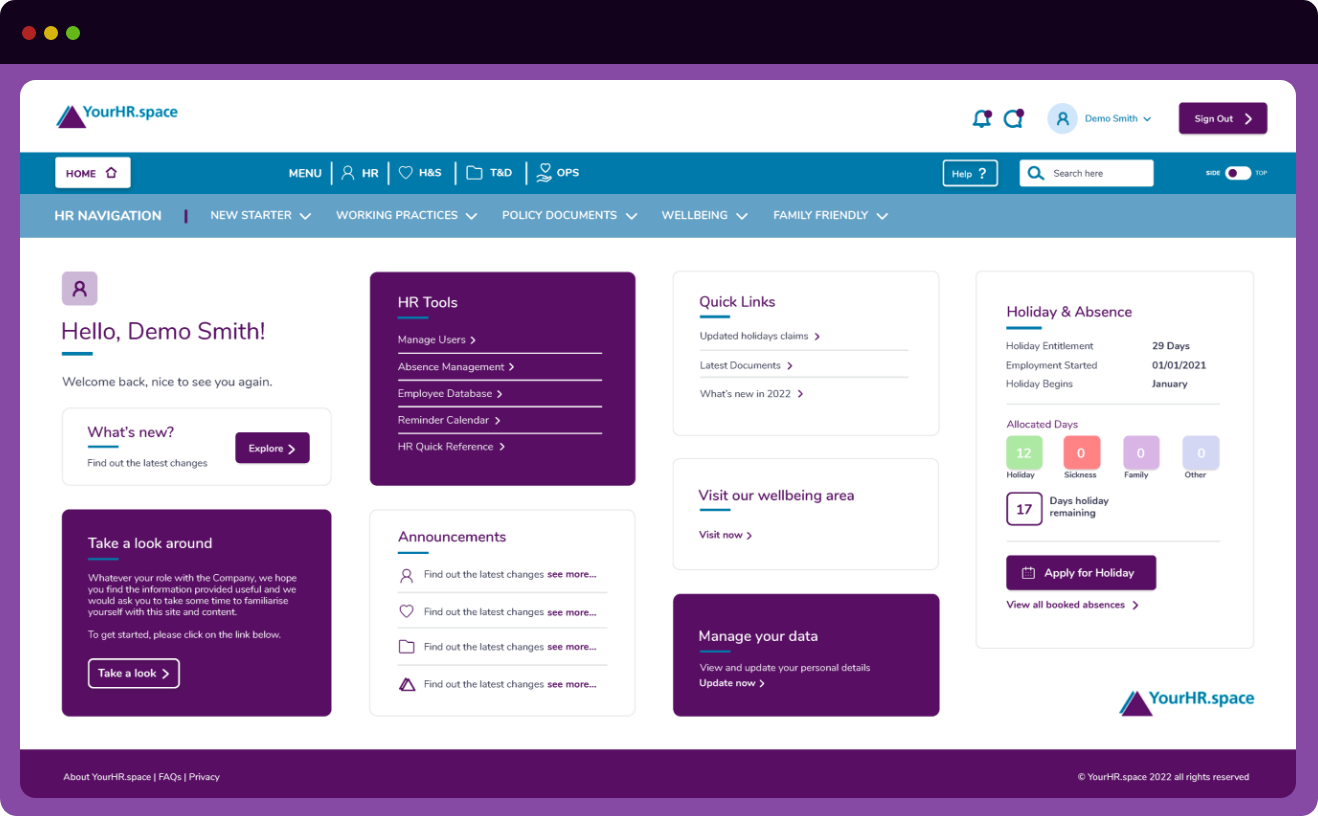

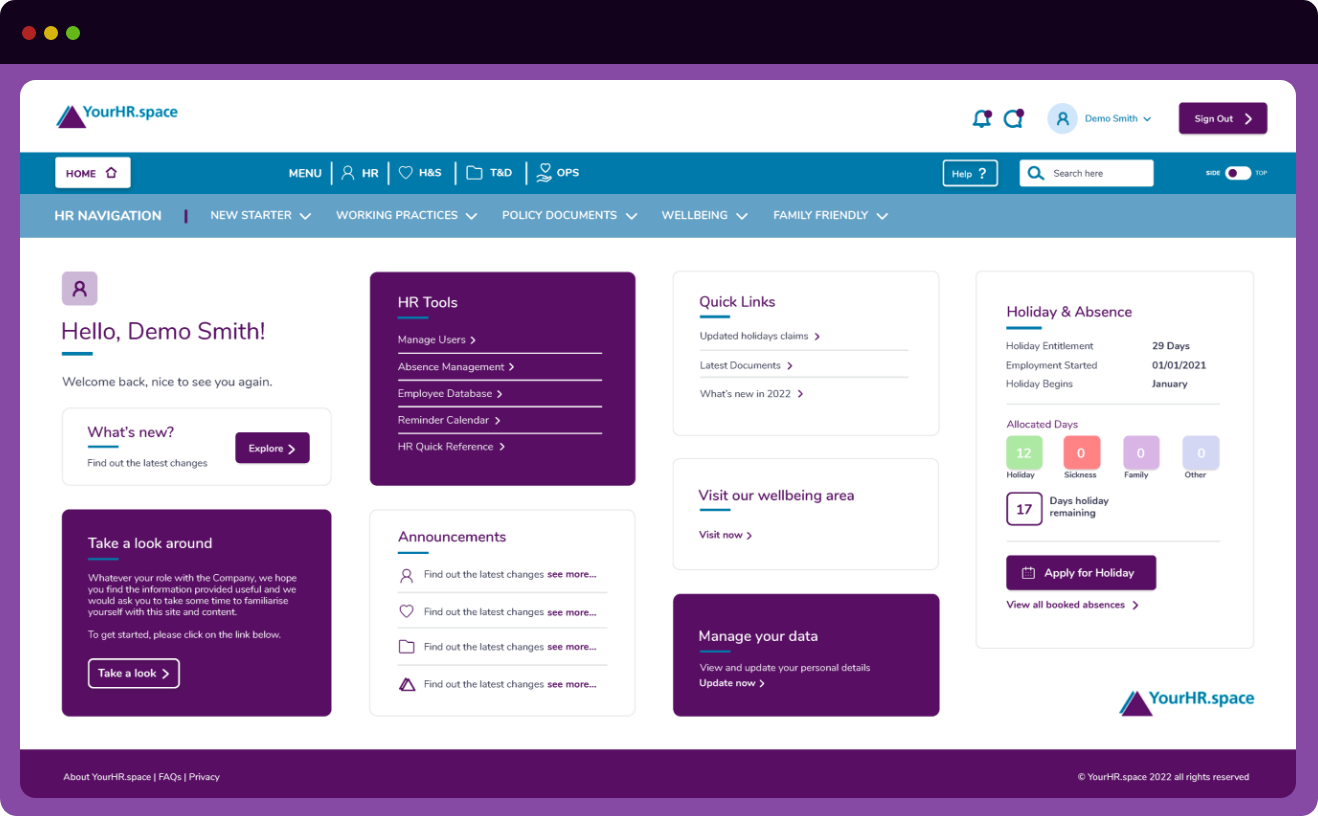

Your own branded HR Portal. With content drafted for you by HR experts and tailored to your organisation. Continually updated in real time. Plus, all the tools you would expect from an HR software system.

It’s easy to get started and get HR peace of mind. We do all the hard work for you, from drafting your content to configuring your Portal.

You will have an HR foundation that will support your business and always be up to date and compliant plus an Account Manager always on hand to answer any questions and help you get the most out of YourHR.space.

Your team will be more engaged with enhanced communication, easy to use tools and a central reference point for everything HR.

Let's talk1

Schedule a call

Stop worrying about HR. See how YourHR.space can give you more time to focus on growing your business.

2

Set it up

Your HR consultant will create your content and your dedicated account manager will work with you to configure your Portal.

3

Get HR peace of mind

Say goodbye to HR headaches. Your team will be more engaged and you'll have a HR foundation to support your business.

Create contracts of employment for new starters, that can be signed online and automatically stored in the employee database.

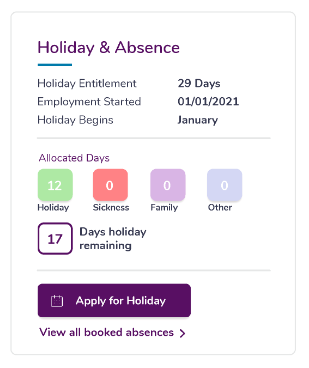

Manage holiday request, view calendars and see who is off, approve or decline holiday requests at the touch of a button.

Secure online storage of employee records, easy access to information and ensures compliance with data protection.

Set reminders from probationary periods, birthdays, work anniversaries or training requirements or anything else.

Set up and send recurring email notifications (e.g., to remind staff to book holidays). Send notifications to individuals or specific departments of the Company.

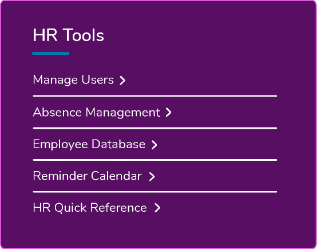

Manage users including adding new users and archive leavers. View when users last visited the Portal.

Access and read guidance on how to manage employment processes, including disciplinary and grievance.

Run standard reports or create your own. YourHR.space online system helps you create the reports your require.

Complete your induction online in your own time, with step-by-step guidance, training videos and checklists.

Employees can view calendars for your department and request holiday. View your entitlement and dates of holiday you have taken or booked.

Access, view and refer to HR policies, company working practices, standards, and codes of conduct. Access at any time on any device.

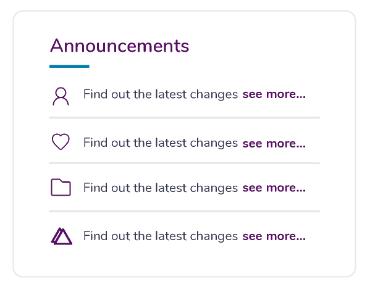

Receive notifications about updates or changes. Always be up to date when policies, procedures or working practices have been updated.

View information about all areas of wellbeing (physical, emotional, financial etc), with contact details of where to find additional support.

Update your own personal details and emergency contact information to ensure records are accurate.

View your employment details and request a change if you think something is out of date.

Access your employment documents including your contract of employment.

Denise Rossiter, CEO

Essex Chambers of Commerce

Ian Hornsey, Managing Director

Devonports Accountants

Karen Sallows, Director

Crown Vocational College

Neil Boatman, Director

Image on Workwear

Tracey McCormick

Purple Starfish Consulting